ORLY-EP0168A - Money Canada Pays Rent?

Welcome to ORLYRADIO #168 recorded Friday, October 20th, 2017 - where we dismantle the current events for your edutainment through mostly rational conversations that make you go ‘Oh Really’! I’m your host Andy Cowen with the usual suspects, Daniel Atherton, Fred Sims.

We make mistakes. Please, if you find one, pause the podcast, and send us a note. orlyradiopodcast@gmail.com or phone it in 470-222-6759

Thank you to our Patreon Supporters!

Donald Davis

Melissa G.

Henry

Daniel Duncan (Problem Addict Podcast)

Following the Money - Market Watch:

October Friday Closing changes week to week.

OCT: Week 1 - 10/06/17: https://www.zacks.com/stock/news/278014/stock-market-news-for-oct-6-2017

Dow Jones Industrial Average (DJIA) closed at 22,775.39 UP $394.39

Nasdaq Composite Index (IXIC) closed at 6,585.36 UP $131.91

S&P 500 Index (INX) closed at 2,552.07 UP $42.01

OCT: Week 2 - 10/13/17: https://www.zacks.com/stock/news/278753/stock-market-news-for-oct-13-2017

Dow Jones Industrial Average (DJIA) closed at 22,841.01 UP $65.62

Nasdaq Composite Index (IXIC) closed at 6,591.51 UP $6.15

S&P 500 Index (INX) closed at 2,550.93 Down $1.14

From Zacks: New Economic Data

The weekly initial jobless claims plummeted to 243,000 from last week — a decline of 15,000. This marked its lowest level in as many as six weeks. The consensus estimate for the period was 255,000 claims. Economists commented that only a few Americans applied for unemployment benefits in this period as business resumed in Texas and Florida, with more people resuming work, post the recent carnage by two destructive hurricanes.

Moreover, initial claims in Puerto Rico were also lower not because of people going back to work but due to the absence of electricity after the island was ravaged by Hurricane Maria. Consequently, people could not file claims from the island nor could the claims be processed. As a result, the analysts expect such claims to show up in the coming weeks.

OCT: Week 3 - 10/20/17: https://www.zacks.com/stock/news/279501/stock-market-news-for-oct-20-2017

Dow Jones Industrial Average (DJIA) closed at 23,163.04 UP $322.03

Nasdaq Composite Index (IXIC) closed at 6,605.07 UP $13.56

S&P 500 Index (INX) closed at 2,562.10 UP $11.17 recovering over last week.

From Zacks: The Dow Jones Industrial Average (DJIA) Jones and S&P 500 overcame selling pressure and eked out records on Thursday that marked the 30th anniversary of the ’87 crash. Robust third-quarter earnings results provided a fillip to the equity market, with American corporations showing signs of strength on the back of an improving economy. Political tensions in Europe and lackluster economic reports out of China failed to dent investors’ sentiment. On the other hand, a report that showed Federal Reserve Governor Jerome Powell is the leading candidate for the nominee for Fed chair boosted investors’ confidence. Appointment of Powell would represent a continuation of the central bank’s current regime.

Following the Money - OIL

http://www.Nasdaq Composite Index (IXIC).com/markets/crude-oil.aspx

WTI (NYMEX) Price

October:

Week 1: $49.29 USD Down $2.38 Back to July Prices.

Week 2: $51.45 USD UP $2.16

Week 3: $51.84 USD UP $0.39

Following the Money - Exchange Rates

International Monetary Fund (IMF) XDR/SDR Basket Currencies

Five most-traded currencies in the foreign exchange market referenced against the US Dollar.

October:

Week 1: $1 USD = €0.85 Eur = ¥6.57 CNY = ¥112.63 JPY = 0.77 GBP = 0.00023 Bitcoin

Week 2: $1 USD = €0.85 Eur = ¥6.59 CNY = ¥111.82 JPY = 0.75 GBP = 0.00018 Bitcoin

Week 3: $1 USD = €0.85 Eur = ¥6.62 CNY = ¥113.53 JPY = 0.76 GBP = 0.00017 Bitcoin - 1 Bitcoin = $6004.00

Bitcoin transactions use so much energy that the electricity used for a single trade could power a home for almost a whole month, according to a paper from Dutch bank ING.

https://www.weforum.org/agenda/2017/10/the-electricity-required-for-a-single-bitcoin-trade-could-power-a-house-for-a-whole-month/

Of the precious metals, we usually think of Gold, Silver and Platinum, but now, Palladium has been added to this fellowship.

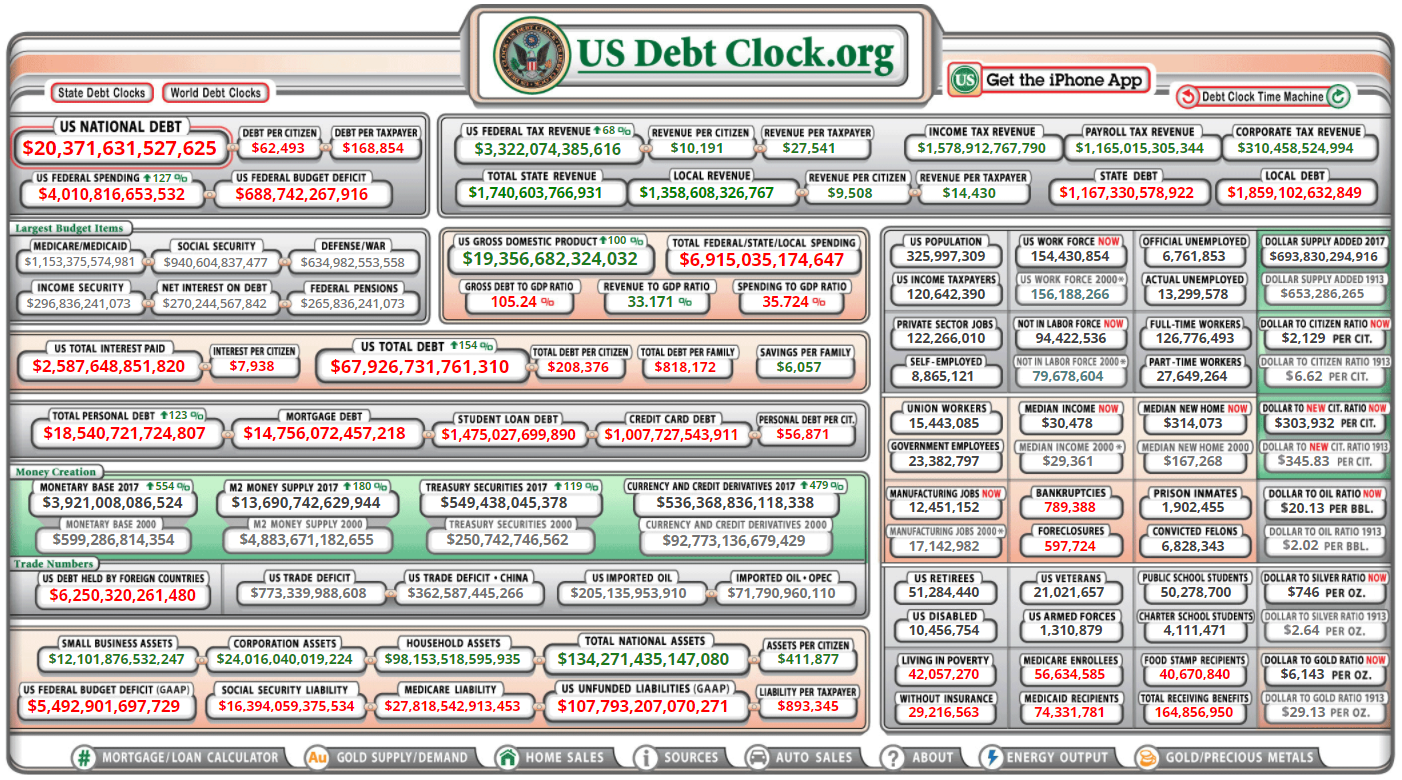

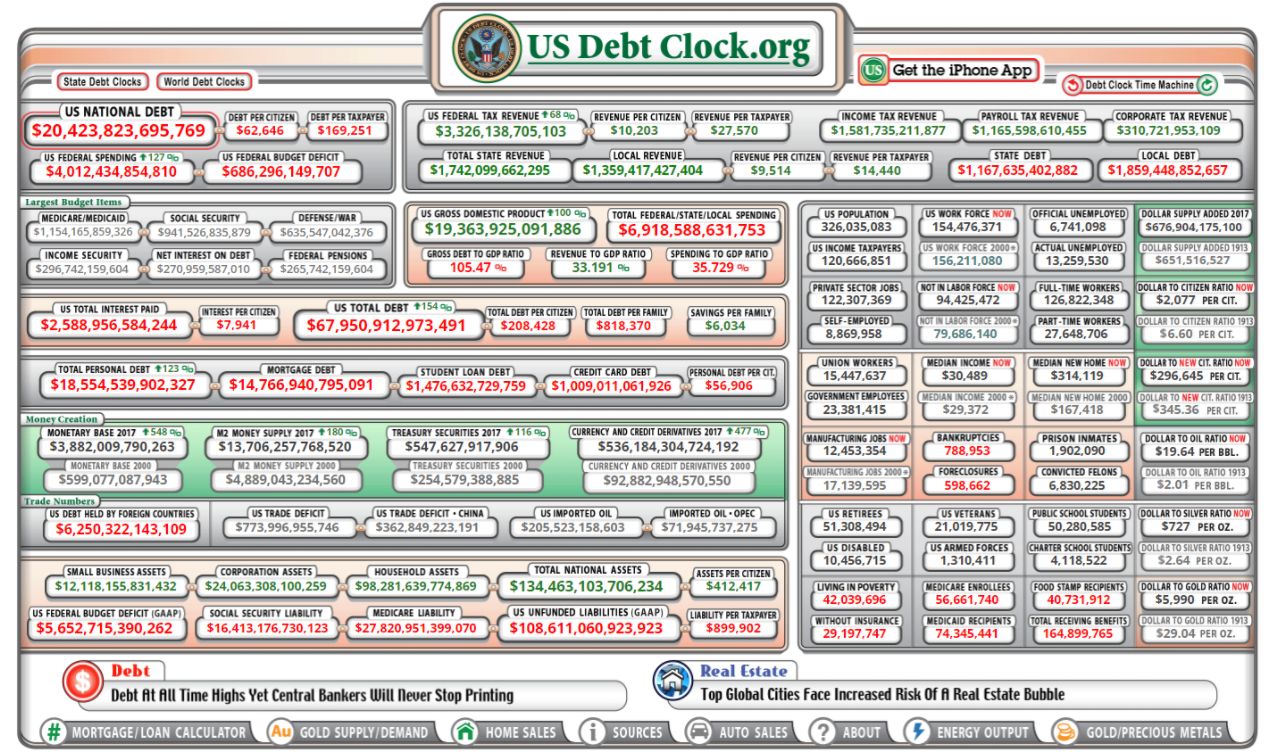

US National Debt Ticker

Watch that puppy grow! http://www.usdebtclock.org/

October 6th: $20,345,281,729,369 UP $167,279,984,763

October 13th: $20,371,631,527,625 UP $26,349,798,256

October 20th: $20,423,823,695,769 - UP $52,192,168,144

U.S. job loss: Trump or Climate Change? As a followup, looks like it was the hurricanes. http://www.politico.com/story/2017/10/06/economy-lost-jobs-in-september-2017-243532?cmpid=sf

First Nations seek to raise Canada's rent after 150 years of $4 payments

The First Nations claim that their ancestors initially balked at what seemed like a paltry sum for their resource-rich land. “So what William Benjamin Robinson said – and I’m paraphrasing – was: ‘Here’s what I’ll do. I’ll offer you this annuity and if the territory produces more revenue for the crown, the annuity will be increased accordingly,’” said Mike Restoule, one of the representative plaintiffs in the case.

The treaty stipulates that any increase in the annuity “shall not exceed the sum of 1-pound provincial currency in any one year, or such further sum as Her Majesty may be graciously pleased to order”.

More than a century after the first increase, despite petitions and appeals from First Nations chiefs to various levels of government, the annuity remains unchanged.

https://www.theguardian.com/world/2017/oct/15/canada-first-nations-treaty-annuity-lawsuit

http://www.canadianlawyermag.com/legalfeeds/author/elizabeth-raymer/robinson-treaties-first-nations-launch-court-actions-over-annuity-augmentations-14754/

If you’ve enjoyed what we do here and would like to help us out, there are a few ways.

You can donate to the show through www.Patreon.com/orlyradio

Make the Algorithm work for us by reviewing us on iTunes to boost our ranking.

Use your Words and tell someone about us.

And of course, engage us! Send us an message on the social medias or the electronic mails @ ORLYRADIOPODCAST@gmail.com or if you are the more talkative sort 470-222-ORLY (6759) is always ready to take your call or text.

And if you don’t like what we’ve done here this evening, you can contact the National Suicide Prevention Hotline at 1-800-273-8255, available 24 hours a day, 7 days a week. The Lifeline provides free and confidential support for people in distress, prevention and crisis resources for you or your loved ones, and best practices for professionals.

Thank you for choosing us to waste your valuable time on! This has been ORLYRADIO, Part of The Random Acts Company.

This work is licensed under a Creative Commons Attribution 3.0 United States License, including the music Rocket and Pamgaea created by Kevin MacLeod (www.incompetech.com)